Approach and methods

In this study, the financial and economic feasibility analysis is high-level because the proposed shortlisted NbS projects are in an early stage of development and design and data availability is limited. High-level means that the steps of a standardised cost benefit analysis (CBA) process are followed, but that identification of costs and benefits is mostly based on existing studies and information, and that quantification of identified costs and benefits is only indicative if (secondary) data is available. The results of a high-level feasibility analysis indicate potential financial and economic viability of the NbS measures. Moreover, by going through the CBA steps all costs and benefits of the NbS are systematically identified and evaluated, providing objective evidence for the financial and economic feasibility of the shortlisted NbS.

CBA is the main tool to help decision-making in financial and economic analysis. It is a systematic method to assess the effects, i.e. the costs and benefits, of a project on an organisation (financial CBA) or society (economic CBA). Financial and economic CBAs are largely similar, though they use some different terminology, consider different effects and there are some differences in the monetisation of effects. An economic CBA is more comprehensive in the sense that it considers costs and benefits on society, including intangible costs and benefits, that would not be considered in a private investment decision.

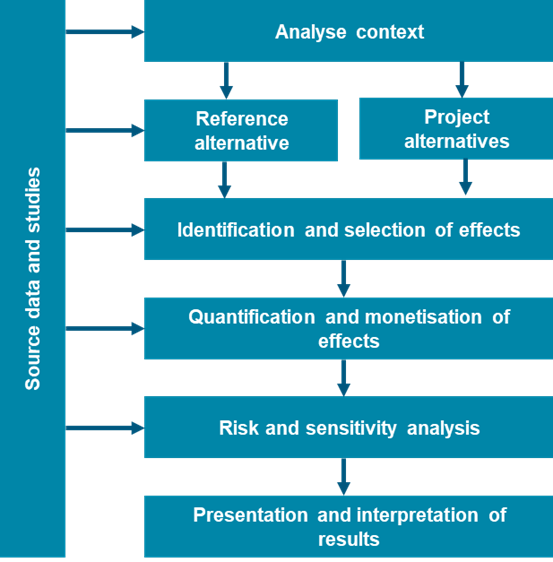

The steps in the figure below show the CBA process. The analyses for the shortlisted NbS go through each of these steps, yet quantification and monetisation of effects and risk and sensitivity analysis is only addressed to a limited extent due to the high-level nature of the analysis. In each of the steps a distinction between local (project) and basin level is made, and an overview is included which benefits are enjoyed by which stakeholder.

Step 1

The main purpose of this step is to get a thorough and complete understanding of the shortlisted NbS. This includes understanding the case study sites, key challenges, objectives and policy goals. The context will be considered at both the case study scale and the basin scale. Developing an understanding of which stakeholders are involved is also part of this step. The contexts for the shortlisted NbS are mainly developed in the technical analysis; here only a very brief summary is provided and the (potential) stakeholders are identified.

Step 2

The reference alternative is the case without the shortlisted NbS. Definition of the reference alternative is important, as it defines what the shortlisted NbS are compared with. Costs and benefits can only be determined incrementally; you cannot determine the effects of a NbS unless you have determined what would happen without their implementation. The reference alternatives will briefly describe the without-NbS situation.

Step 3

The project alternatives are the three shortlisted NbS. Project alternatives should be clearly defined projects or policies, so that their effects can be identified and quantified. At the local level, three case studies – one for each NbS – have been developed in the technical analysis. These case studies provide sufficient level of detail for a high-level economic and financial assessment. As there are no concrete project or programmes descriptions or designs at the basin scale, assumptions have been made on the scale of NbS implementation for assessment in the CBA.

Step 4

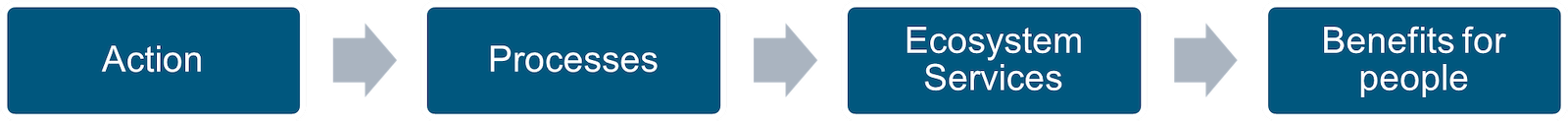

Implementing the shortlisted NbS will have several effects that ultimately lead to the costs and benefits of different stakeholders at different scales. Effects are wide ranging and include for instance costs for sluices and gates, costs for training of farmers, change in yield of rice leading to changing incomes for farmers, increased areas for spawning of fish leading to a larger fish stock, higher incomes from fisheries and reduced flood damages. Identification of effects will follow the structure of an ecosystem services assessment[1], which links an action to benefits for people through an ecological production function.

[1] The ecosystem services assessment approach is presented in Boris van Zanten, Gonzalo Gutierrez Goizueta, Luke Brander, Borja Gonzalez Reguero, Robert Griffin, Kavita Kapur Macleod, Alida Alves, Amelia Midgley, Luis Diego Herrera, and Brenden Jongman. 2023. Assessing the Benefits and Costs of Nature-Based Solutions for Climate Resilience: A Guideline for Project Developers. World Bank, Washington, DC.

Figure. Ecosystem services assessment

Effects experienced by different stakeholders and at different scales could be different, hence identified effects will be related to stakeholders and to project versus basin scale. Moreover, effects could be tangible (e.g. investment costs, increased revenues) and intangible (e.g. increased resilience). Intangible effects are difficult to quantify or measure. Selection of effects for quantification is based on their expected significance for final outcome, the ability to quantify them, and data availability. Effects that are not selected, will be discussed qualitatively.

Step 5

Quantification of effects will be based on the high-level designs/ideas for the three case studies and based on the assumptions for upscaling the NbS. The quantification will be very indicative and only for effects for which data is available. Monetisation for effects that can be quantified will be based on secondary data, and existing studies and reports. Selected effects that cannot be quantified will be discussed qualitatively. With the quantified and monetised effects a simple present value calculation will be conducted to calculate an indicative economic net present value (NPV), benefit cost ration (BCR) and internal rate of return (IRR) for society.[1] The assumptions for these calculations are a social discount rate of 6%[2] and a project lifespan of 50 years. The base year and price levels of the calculations is 2024.

[1] Based on the available data and due to lack of tangible benefits it was not possible to calculate the financial NPV, BCR and IRR.

[2] While previously development banks used SDRs of 8-12%, increasingly lower discount rates are used, particularly for sustainability and climate-related projects (e.g. 6% for Vietnam, see World Bank (2022), Accelerating Clean, Green, and Climate-Resilient Growth in Vietnam: A Country Environmental Analysis, Supplementary Technical Note. World Bank.

Step 6

Due to the very preliminary nature of the analysis, it is not relevant to conduct a risk and sensitivity analysis.

Step 7

The final step is the presentation and interpretation of results, which is reported in the chapters below.

Following the CBA, a qualitative financial analysis will be conducted in which the tangible cashflows from the projects are identified and an assessment is made of potential avenues for funding the projects.